Shareholders Return

Dividends

(1) Dividend policy

We considers returning profits to shareholders as a management priority. Our basic policy is to continuously distribute profits twice a year in the form of interim and year-end dividends based on our business performance, and to enhance corporate and shareholder value by effectively utilizing retained earnings.

From the fiscal year ended March 31, 2024,we have decided to target a consolidated payout ratio of 40% and set the minimum DOE (dividend on equity ratio) at 3.5% to enhance profit distribution in line with business performance and ensure stable dividends. Note that profit attributable to owners of parent, which serves as the basis for calculating dividend payments, calculated based on business activity profits excluding extraordinary gains and losses, etc.

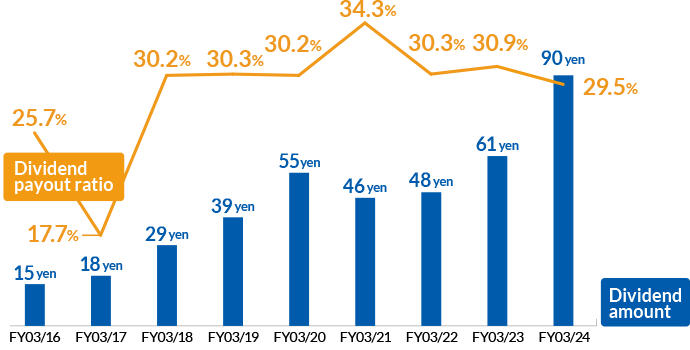

(2) Historical dividends

The annual dividend per share for the fiscal year ending March 2025 was 99 yen.

Dividend payout ratio is 29.5% in FY03/24 and 37.6% in FY03/25 based on reported profit attributable to owners of parent

Timing of payment

As a general rule, we pay dividends twice a year (interim and year-end).

Interim dividends : Around late November/Year-end dividend : Around mid-June

Shareholder benefits

Once a year, we present a catalog of shareholder special benefit products to shareholders who hold a minimum of 100 shares as of September 30, giving shareholders a variety of products and donations to choose from.